Sustainable growth tools for creators

ConvertKit helps 600k+ creators like you work smarter – not harder – with email, automation, and monetization tools that work together to drive continuous growth.

14-day free trial. No card required. Free migration service.

The marketing hub you can rely on to:

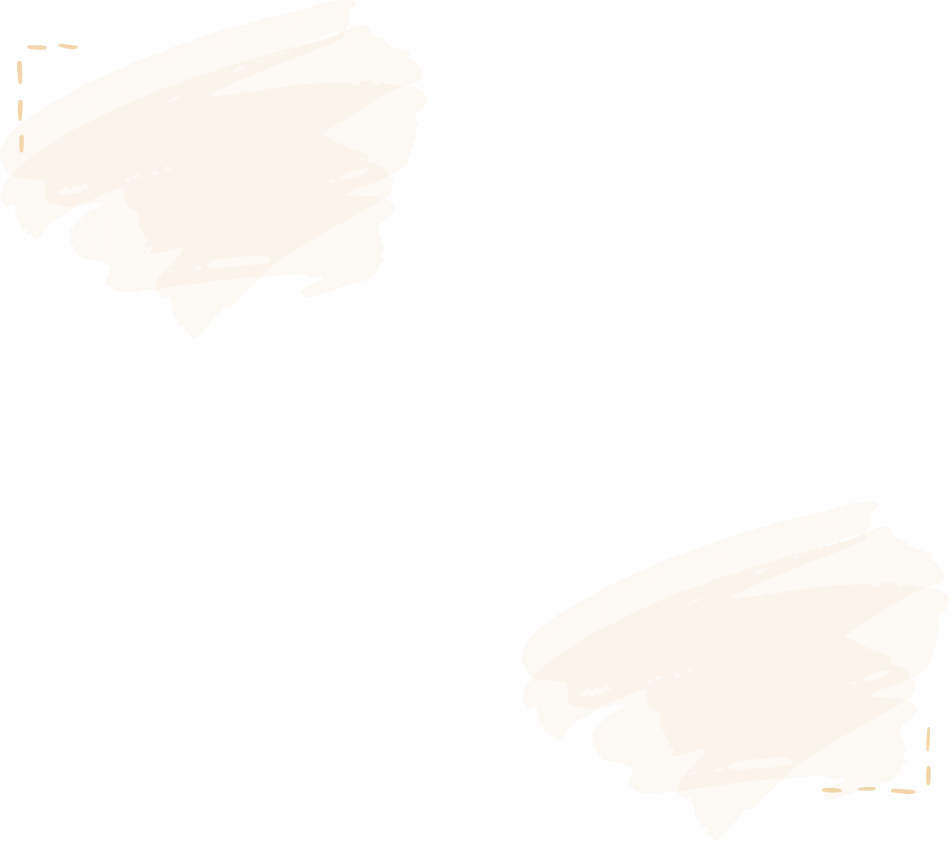

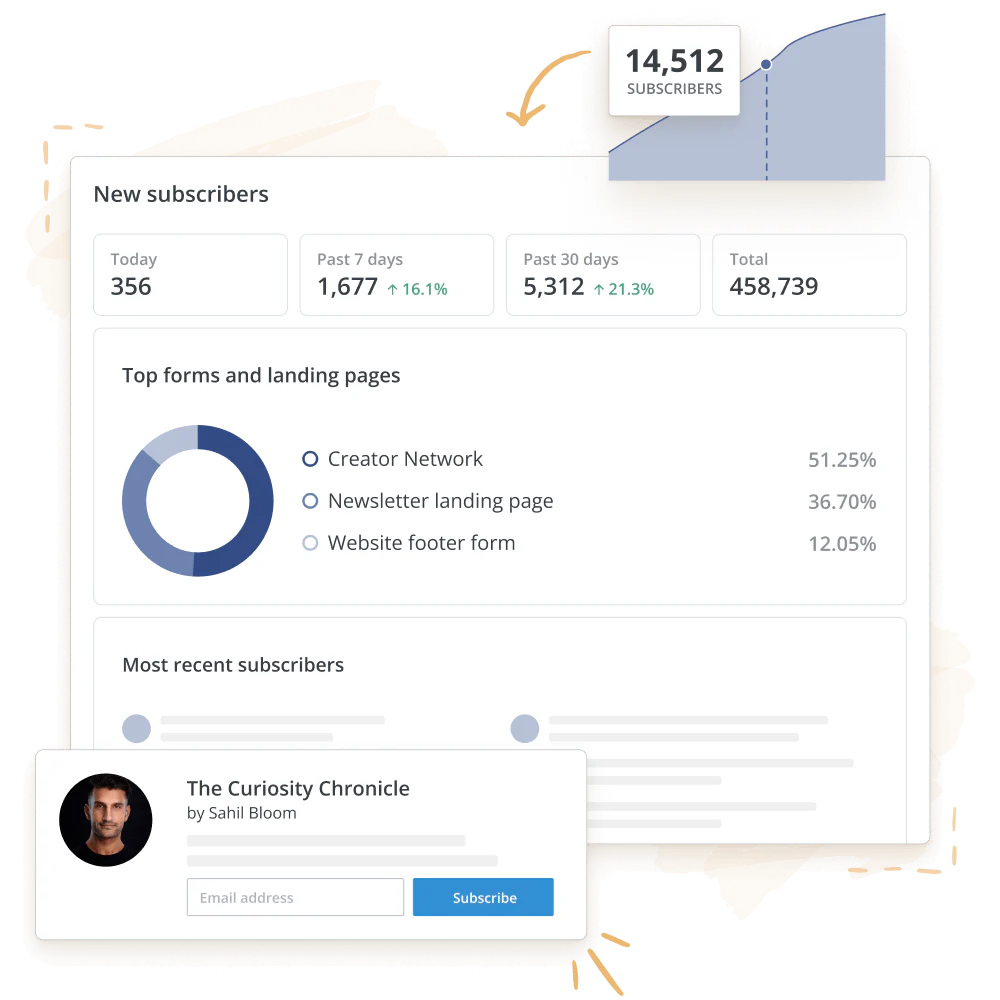

Increase subscribers with customizable landing pages, sign up forms, and link pages that make your work stand out.

Tap into the largest network of creators who can help you reach new audiences and grow your list through Recommendations.

More than 659,257 creators send over 2.5 billion emails each month

Your favorite creators use ConvertKit to connect with their audience and earn a living online.

The marketing hub you rely on to:

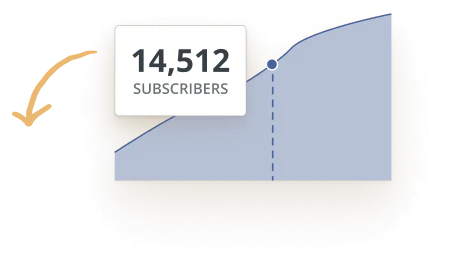

1Grow your audience

Increase subscribers with beautiful landing pages, sign up forms, and link pages that make your work stand out.

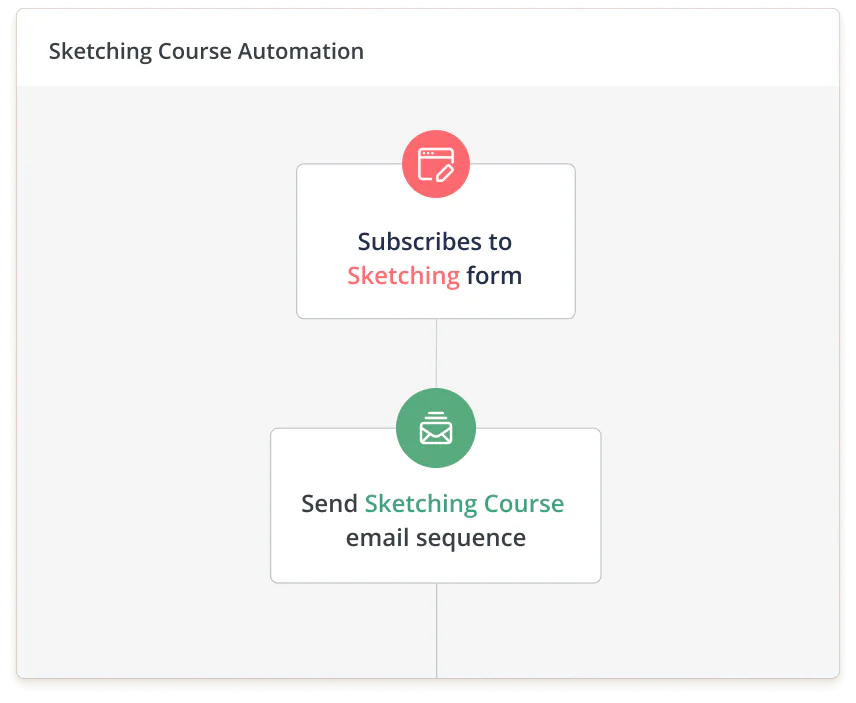

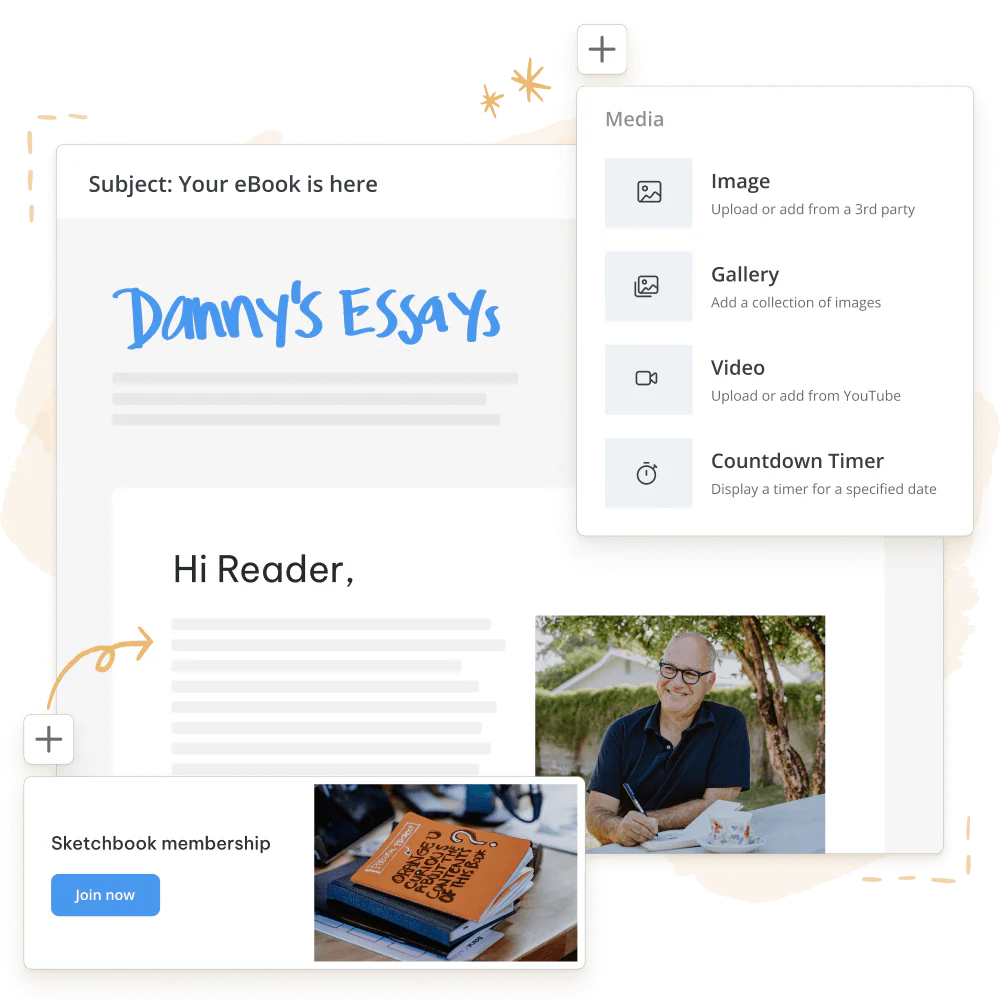

2Automate your marketing

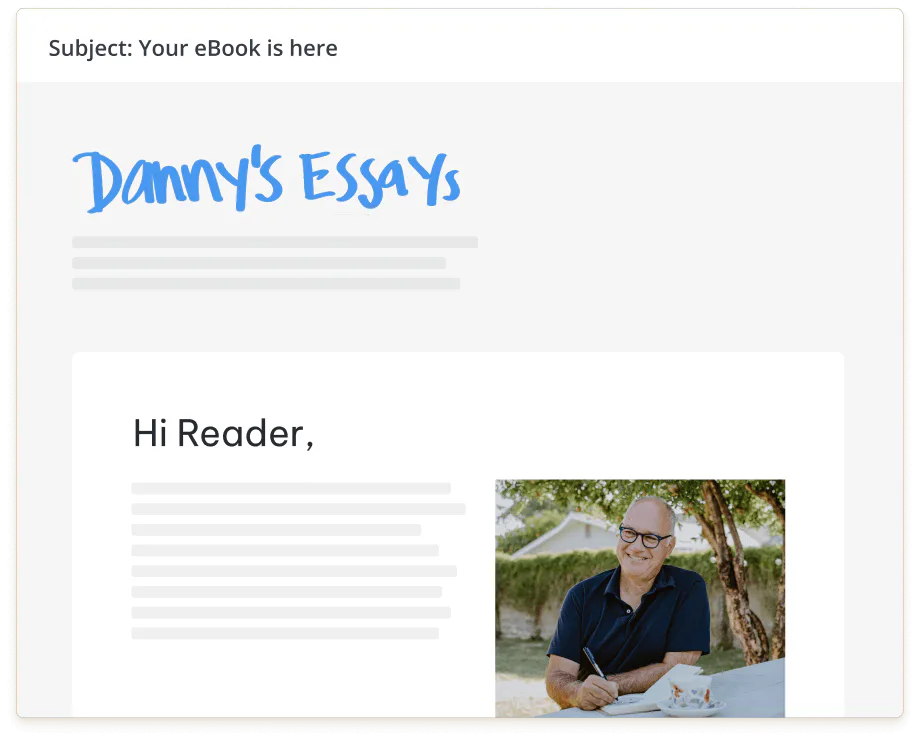

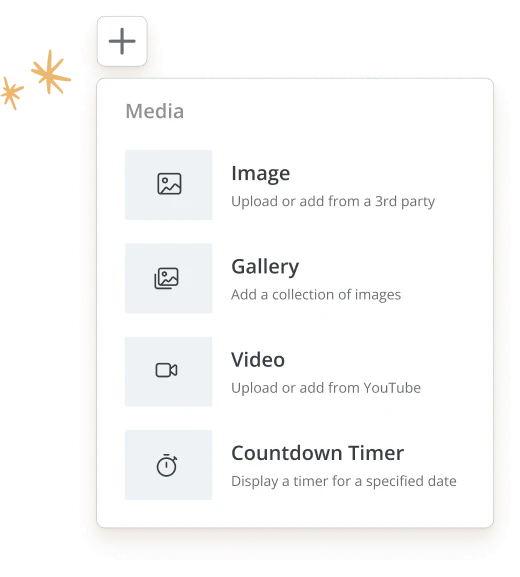

Create lasting connections and promote like a pro with our intuitive email editor and powerful sales funnels.

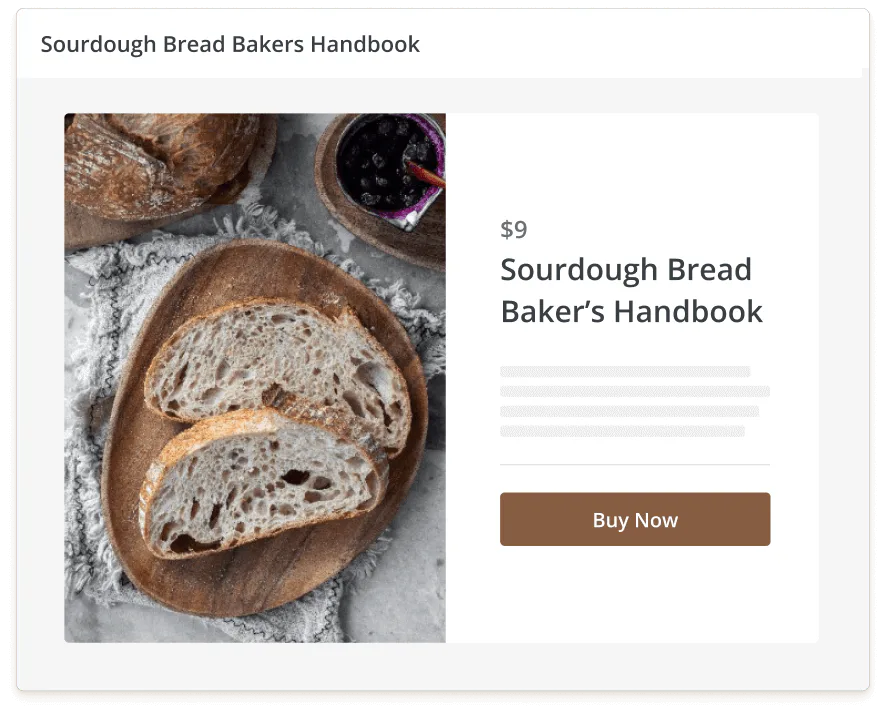

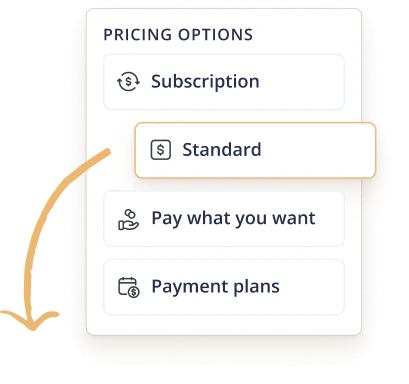

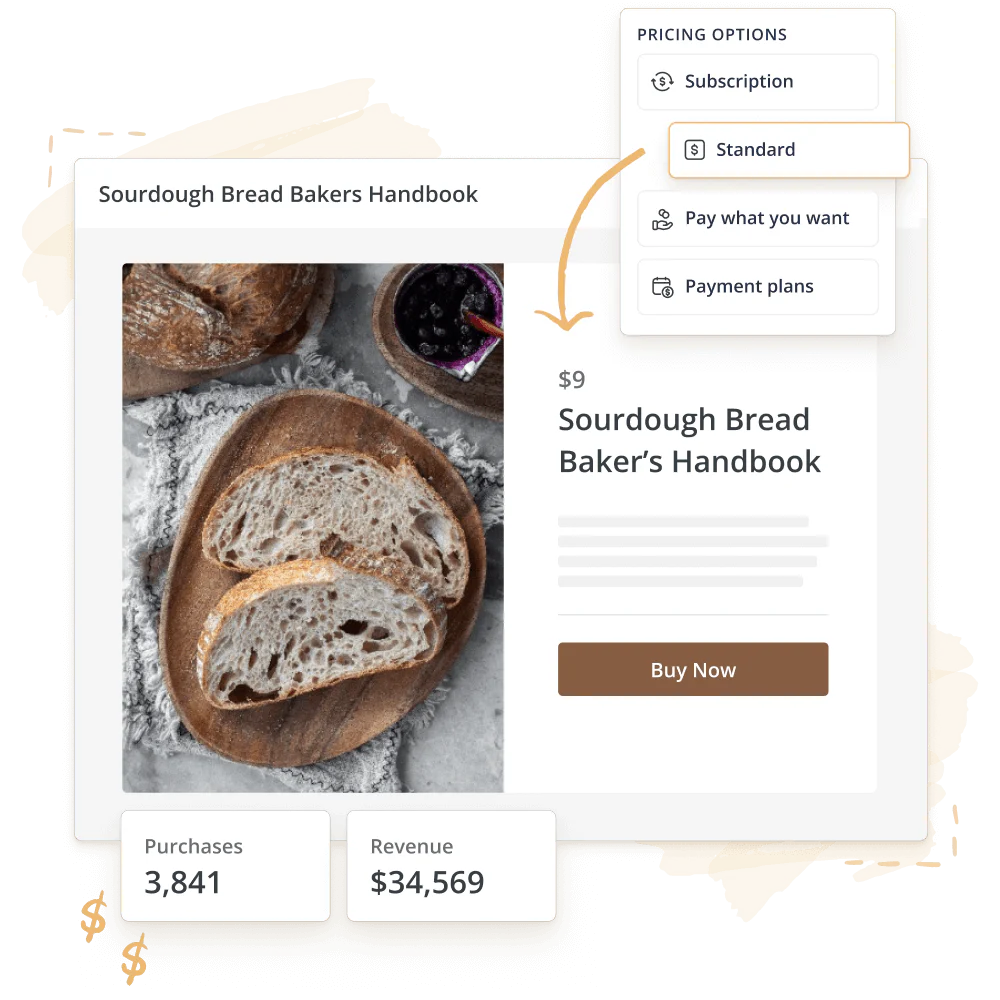

3Sell your digital products

Market and sell your digital products and subscriptions with ConvertKit to drive higher conversions and save big on fees.

We help coaches reach more clients

"I've sent a lot of people over to ConvertKit because I am so appreciative of the ease and the way ConvertKit makes it possible for a regular individual, not a specially trained certified mechanic, to handle one's email list."

— Dorie Clark, bestselling author & executive coach

We help authors earn more from their work

"ConvertKit's breadth of tools really expands the possibilities of work that can be done, and being able to monetize it all is so key. Love the ease of the platform for use."

— Luvvie Ajayi Jones, New York Times Bestselling author & podcaster

We help podcasters connect with listeners

"ConvertKit lets me build a relationship with my listeners beyond audio. Now, every week, listeners not only hear my voice but can read the story behind the episode too!"

— Jay Clouse, podcaster

We help musicians build their audience

"Marketing is the thing that makes sales possible. And you have to segment your customers and prospects. Now I do a lot of that segmentation with ConvertKit."

— Chris Howes, violinist

We believe the future belongs to creators

Creators shape culture and culture shapes the world. Check out these stories, films, and sessions to be inspired by the creative process of artists, writers, musicians, and more.

Start earning more with ConvertKit

Build your audience with ConvertKit or bring them with you from your current platform. We’ll even move your subscribers from your previous tool with our free concierge migration service.